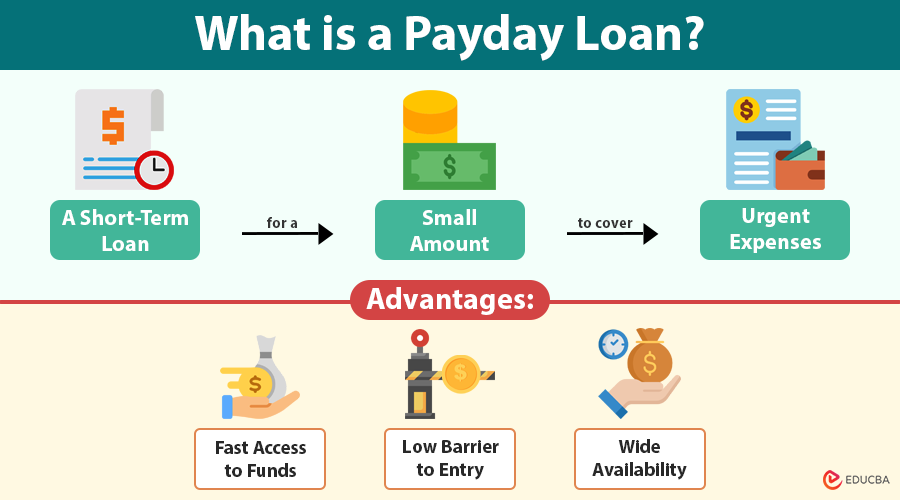

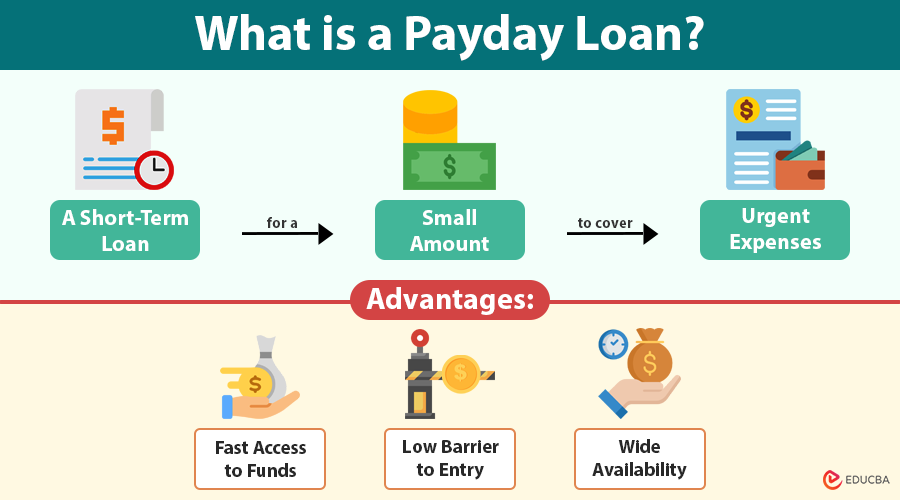

What Is a Payday Loan?

A payday loan is a short-term loan for a small amount of money, usually meant to cover urgent expenses. It typically comes with very high interest rates and is expected to be repaid by your next paycheck, usually within two to four weeks.

A payday loan is marketed as a quick financial solution for emergencies when cash is scarce. Loan amounts in the U.S. usually range from $100 to $1,500, depending on your state’s regulations and the lender’s terms.

They provide quick access to money, but they come at a higher cost than traditional loans. They require no collateral and little to no credit check, making them accessible but financially risky.

The Consumer Financial Protection Bureau (CFPB) states that a typical two-week payday loan with a $15 fee for every $100 borrowed has an annual interest rate of nearly 400%.

Table of Contents

Key Features of Payday Loans

Let us take a closer look at the unique characteristics of payday loans:

- Short-term repayment: The loan is typically due within 14 to 30 days, often aligned with your next paycheck. This short window can make repayment difficult, especially if you are already behind on other bills.

- No credit check: Most payday lenders skip credit checks and only look at your income. This allows people with bad or no credit to borrow, but increases the risk for lenders, which they offset through higher fees.

- Sky-high interest rates: Unlike traditional loans, payday loans have triple-digit APRs. This means you could pay far more than you borrowed in just a matter of weeks.

- Fast cash delivery: Lenders promote same-day or instant disbursement, especially online. For someone facing urgent needs, such as medical bills or rent, this immediacy is appealing.

- Unsecured loan: You do not need to give any collateral, so your car or property is not at risk. However, the lender may request a post-dated check or authorization to withdraw funds directly from your bank account.

How Do Payday Loans Work?

Lenders design the entire payday loan process for speed and simplicity:

- Application: Borrowers apply online or in person, submitting basic details like:

- A valid ID (e.g., driver’s license)

- Recent pay stubs or proof of income

- A checking account in good standing

- Approval and agreement: If you meet the basic criteria, you will receive a loan agreement detailing:

- The loan amount

- Finance charges

- APR

- Repayment due date

- Additional fees or rollover terms

- Disbursement of funds: The lender deposits the money into your account or provides you with cash, typically within hours.

- Repayment: The full amount, including fees, is withdrawn from your account on the due date. If the funds are not available, you could face NSF fees, overdraft charges, or default.

Many borrowers roll over their loans or take new ones to cover existing debt, leading to a dangerous debt spiral.

Who Typically Uses Payday Loans?

Payday loans disproportionately impact financially vulnerable Americans:

- Low-income workers: Those earning minimum wage or living paycheck to paycheck may turn to payday loans to bridge the gaps between expenses and income.

- People with poor credit: Payday lenders rarely pull credit reports, making them a viable option for those whom banks or credit unions have denied.

- Gig workers and freelancers: Inconsistent income streams can lead to cash flow shortages, prompting these workers to seek high-interest short-term loans.

- Military families and young adults: Lack of financial education, unexpected expenses, and limited access to credit make these groups more susceptible.

A Pew Charitable Trusts study found that 70% of payday loan users use the money to cover recurring expenses, such as rent, food, and utilities, rather than one-time emergencies.

Advantages of Payday Loans

Though payday loans come with significant risks, they offer certain benefits that make them appealing during a financial crunch:

1. Fast Access to Funds

Approval takes minutes, and you could receive funds the same day, critical in emergencies like:

- Medical bills

- Urgent car repairs

- Eviction notices or utility shutoffs

2. Low Barrier to Entry

Unlike bank loans, you do not need a high credit score, collateral, or lengthy paperwork. Most lenders require:

- Proof of income

- S. citizenship or residency

- Bank account details

3. Wide Availability

You can get payday loans in stores, online, or through mobile apps anytime — even on weekends and holidays.

Risks and Disadvantages

While the convenience is tempting, payday loans carry severe financial consequences if not repaid on time:

1. Exorbitant Interest Rates

APR rates ranging from 300% to 500% mean that for every $100 borrowed, you could owe $15–$30 in just two weeks. This makes payday loans the most expensive legal form of credit in the U.S.

2. Debt Cycle Danger

Borrowers who cannot repay on time often roll over the loan, triggering additional fees. This leads to a cycle of debt, where repayment becomes increasingly difficult over time.

3. Short-Term Repayment Pressure

A two-week deadline may be unrealistic for many borrowers, especially those with fixed incomes or multiple financial obligations.

4. No Long-Term Credit Benefit

Repaying on time does not typically boost your credit score, as most lenders do not report to credit bureaus. However, lenders can harm your credit if they send missed payments to collections.

Real-Life Example

Case Study: Angela from Ohio

Angela borrowed $400 for emergency car repairs. Her two-week payday loan came with a $60 fee. When she could not repay in full, she rolled it over twice. By the time she settled the loan two months later, she had paid over $800, twice what she originally borrowed.

This illustrates how payday loans can balloon into unmanageable debt, even when they seem harmless at first.

Payday Loan vs. Other Loan Types

| Loan Type | APR (Approx.) | Repayment Term | Credit Needed | Speed of Approval |

| Payday Loan | 300%–500% | 2–4 weeks | No | Very Fast (Same Day) |

| Personal Loan | 6%–36% | 6–60 months | Yes | Moderate (1–3 days) |

| Credit Card Advance | 25%–36% | Flexible | Yes | Fast |

| Employer Advance | 0%–10% | Next paycheck | No | Fast (Same Day) |

Use this table to evaluate whether a payday loan is your best or worst option.

Psychological Triggers Behind Payday Loan Use

Payday loans are often a product of emotional decision-making. Financial desperation triggers panic and shame, making borrowers more likely to accept high-interest terms without scrutiny.

Marketing tactics use phrases like:

- “No questions asked”

- “Instant cash”

- “Bad credit welcome”

These play on your sense of urgency, not logic. Payday lenders count on you acting fast and thinking later.

Payday Loan Traps to Watch Out For

Avoid these common pitfalls associated with payday lending:

- Hidden fees: Loan agreements may include vague or misleading language that can result in unexpected costs.

- Rollover traps: Renewing your loan for another two weeks often doubles your debt in fees.

- Aggressive collections: Missed payments may result in frequent phone calls, text messages, lawsuits, or wage garnishment.

- Bank account overdrafts: Automatic debits from payday lenders can result in bank overdraft fees, exacerbating your financial situation.

How to Escape the Payday Loan Trap?

Here is how you can break free if you are stuck in a payday loan loop:

- Stop borrowing: Refrain from taking out a new payday loan to pay off an existing one.

- Ask for an Extended Payment Plan (EPP): Many states require lenders to provide this at no cost.

- Work with a nonprofit credit counselor: Organizations like NFCC or Credit.org can help restructure your debts.

- Debt consolidation: A personal loan with a lower interest rate can replace multiple payday loans.

- Bank intervention: Ask your bank to block debits from payday lenders to protect your account.

Legal Regulations Around Payday Loans in the U.S.

Payday lending is regulated at the state level, meaning your rights and protections depend on where you live.

- States that ban payday loans: New York, New Jersey, Connecticut, Maryland, Massachusetts, and others.

- States with caps or limits: Colorado, California, and Virginia allow payday loans but cap the interest or loan size.

- Federal oversight: The CFPB enforces rules to prevent predatory lending and automatic withdrawals without consent.

Visit the Consumer Financial Protection Bureau (CFPB) for up-to-date state-specific regulations.

Safer Alternatives to Payday Loans

Explore these better options:

- Credit union or bank loans: Offer lower rates and longer terms—some even offer small emergency loans.

- Installment loans: Fixed monthly payments spread over a longer period, often with better terms.

- Credit card advance: Although interest is high, it is often lower than that of payday loans and includes more flexible repayment options.

- Employer advance: Many companies offer early wage access through payroll apps like EarnIn, DailyPay, or PayActiv.

- Friends & family loans: If handled responsibly, borrowing from someone you trust can save you from high-interest debt.

Free Government & Nonprofit Resources

Before resorting to payday loans, reach out to these helpful organizations:

- 211 United Way Helpline: Dial 211 for local assistance with rent, food, and utilities.

- NFCC (National Foundation for Credit Counseling): nfcc.org

- HUD-Approved Housing Counselors: Assist with financial planning and foreclosure prevention.

- Community Action Agencies: Offer emergency cash grants and services for low-income families.

Financial Literacy Tips to Avoid Payday Loan Debt

- Build an emergency fund: Start with just $20/month. Over time, this cushions you from unexpected costs.

- Budget smart: Utilize free apps like Mint or EveryDollar to track spending and create a budget plan.

- Understand credit: A good credit score can help you qualify for safer loans. Pay on time and keep credit use under 30%.

- Stick to the 50-30-20 method: Use this approach to divide your income: 50% for needs, 30% for wants, and 20% for savings/debt repayment.

- Get educated: Take free financial literacy courses offered by FDIC, MyMoney.gov, or local nonprofits.

Final Thoughts

Payday loans may seem like an easy fix, but they often cause more problems. With extremely high interest, short repayment timelines, and no credit benefit, they are one of the riskiest financial tools available.

Before applying, ask yourself:

- Is this the only option?

- Have I explored alternatives?

- Do I understand all the terms?

When in doubt, speak to a financial counselor. Some simple guidance now can help you avoid falling into long-term debt later.

Frequently Asked Questions (FAQs)

Q1. Are payday loans legal in every state?

Answer: No. Several states have banned or severely restricted payday lending. Always check your state laws.

Q2. Can payday loans hurt my credit?

Answer: Not immediately, but if you do not pay, it can be sent to collections and negatively impact your credit score.

Q3. What if I am unable to repay on time?

Answer: You may face high fees, aggressive collections, and even legal action. Ask about extended repayment options.

Q4. How do I stop payday lenders from debiting my bank account?

Answer: You can submit a written request to your bank to block future debits and revoke authorization.

Recommended Articles

We hope this guide helped you understand payday loans and their impact. Check out these next: